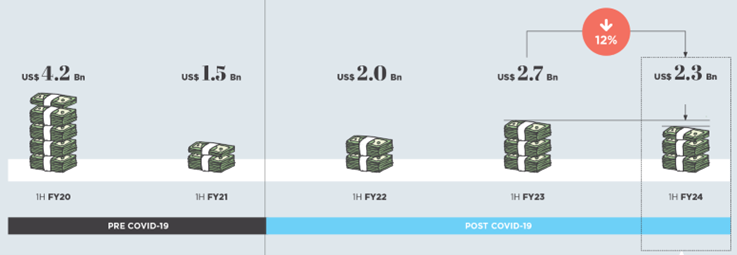

Decline primarily due to lower investments in the residential space

The average ticket size of private equity investments into the Indian real estate sector has increased to USD 117 Mn in 1H FY24, from USD 100 Mn in 1H FY23, finds the ANAROCK Capital report FLUX – 1H FY24.

Shobhit Agarwal, MD & CEO – ANAROCK Capital, says, “This is largely due to a large deal in which Brookfield India Real Estate Trust REIT and Singapore’s sovereign wealth fund GIC together acquired 2 commercial assets – one in Mumbai and other at Gurugram (NCR), from Brookfield Asset Management with an enterprise value of USD 1.4 Bn.”

All transactions in USD ($) unless otherwise stated; Numbers rounded off to the nearest decimal; FY = Financial Year (1st April – 31st March)

Source: ANAROCK Capital Market Research

Top 10 PE Deals in 1H FY24

Overall activity remained muted with headline numbers boosted by this large single deal, with assets across locations. The top 10 deals accounted for 95% of the total value of PE investments in 1H FY24 as compared to 81% in 1H FY23.

- Office assets dominated large ticket equity investments in 1H FY24. This can be attributed towards continued preference by investors in Grade-A office assets with quality tenants.

- Data centres are emerging as a new asset class for investment with a value of USD 73 Mn.

- Residential RE continued as an attractive destination for debt investments in 1H FY24.

All transactions in USD ($) unless otherwise stated; Numbers rounded off to the nearest integer; FY = Financial Year (1st April – 31st March)

Source: ANAROCK Capital Market Research

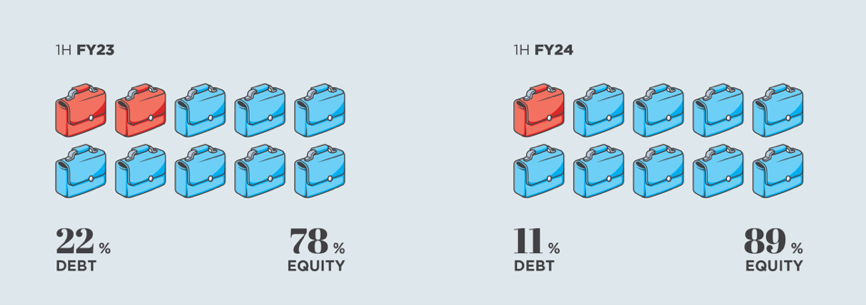

Equity vs Debt Funding

Equity investments continue to be the preferred route by investor, as evidenced from the fact that equity’s share continues to be a healthy at 89%.

FY = Financial Year (1st April – 31st March)

Source: ANAROCK Capital Market Research

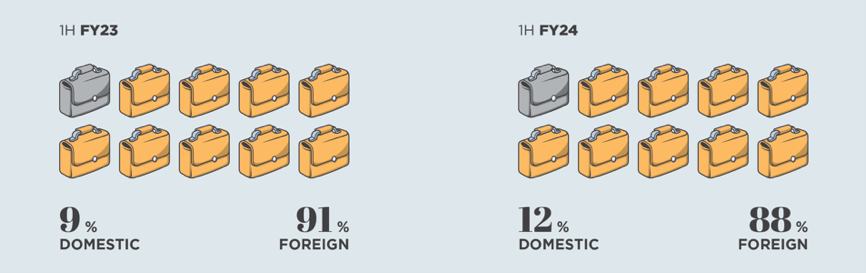

Domestic vs Foreign Funding

Domestic investments increased by 9% (USD 274 Mn) of the total PE capital inflows into Indian RE in 1H FY24, as compared to USD 252 Mn in 1H FY23. The share of foreign investments in 1H FY24 have dropped to 88% as compared to 91% in 1H FY23.

Movement of Capital Flow

Multi-city transactions have increased sharply during 1H FY24, dominated by the Brookfield India REIT & GIC transaction. MMR led the transaction league tables in city-specific transactions, with the city reporting investments of USD 543 Mn in 1H FY24, compared to USD 307 Mn in 1H FY23.

Asset Class-wise Funding

- The commercial RE sector has witnessed an increase in capital inflows via PE investments, accounting for a 78% share of investments received in 1H FY24, as compared to 56% in 1H FY23

- Data centres are emerging as a new asset class for investment with a value of USD 73 Mn.

Key Takeaways

Residential:

“Led by luxury housing sales, demand for residential real estate continued to post robust volumes,” says Agarwal. “The momentum in residential sales has sustained even as an inflationary environment forced the RBI to push up the Repo Rate to 6.5% earlier this year – a level not exceeded since 2016. The underlying fabric of the market remains skewed towards the mid and premium segments constituting the bulk of sales, while the affordable segment witnessed a decline in volume.”

Supply continued to ramp up during the period, and prices continued to rise despite inflation and elevated interest rates.

“The underlying demand remains strong to the backdrop of a robust economy. We expect the current demand trends to sustain in the foreseeable future with volumes expected to hit a new decadal high in CY23. We expect the larger, organised players to continue to account for an increasing share in line with the prevailing consolidation underway in the sector.”

Office:

- While 1H FY24 has seen overall muted activity, the second half of the period saw some stability with good traction in Bengaluru, Hyderabad & Chennai. The revival was led chiefly by the technology & manufacturing sectors.

- Owing to weak demand in preceding quarters, landlords have deferred completions, negatively impacting fresh supplies.

- Rentals have firmed up for Bengaluru & Hyderabad, while remaining stable for other cities.

- Vacancies remained elevated for Gurugram, Noida & Hyderabad, while it remained low for Bengaluru & Pune.

- Vacancies remain elevated as companies optimize for hybrid model strategy and consolidate space requirements.

- The outlook for second half is stable to strong, backed by demand from return to office.

Retail:

- Many international brands like Roberto Cavalli, Foot Locker, Lavazza, Armani Caffe, Jamba and The Coffee Club among many others have announced plans to set up outlets in India.

- Domestic retail operator’s sales have also been strong with healthy growth in demand coming from Tier II and Tier III cities.

- Mall operators are also looking to grow their asset base, looking to cash in on the industry growth.

- The deal street in the retail sector remains buoyant, with several marquee transactions like Qatar Investment Authority and KKR’s investments in Reliance Retail, ChrysCapital’s investment in Lenskart, among others, reported

- The overall outlook for the retail industry is buoyant as consumer spending continues to rise.

Warehousing:

- Demand for warehousing continues to be strong as tenants are seen leaving non-compliant facilities and migrating to facilities which are compliant in all respects. Tenants are also looking to improve utilization of cubic space instead of just the floor space.

- Major sectors driving demand are 3PL, retail, FMCG and automobiles even as demand from e-commerce remains muted.

- A steady rise in demand has led to steady supply creation. There are cyclical spurts where the supply surpasses the demand leading to double digit vacancies, but as the balance is restored the vacancy comes to a normally acceptable tolerance level.

- Rising input costs have also led to a rise in rentals. Some vacancy is healthy for developers as very often they get a rental premium when catering to an immediate demand.

- Developer funds are actively looking at Tier II cities and state capitals like Ludhiana, Rajpura, Lucknow, Bhubaneshwar, Patna, Nagpur, Coimbatore, Cochin.

Click here to download ANAROCK Capital FLUX – 1H FY24